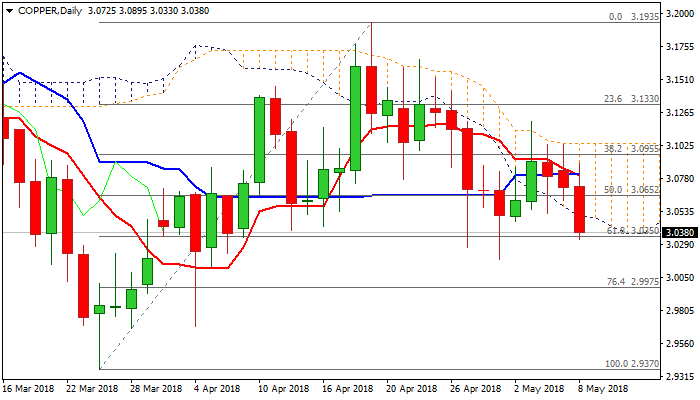

COPPER accelerates lower and breaks below thick daily cloud

Copper price accelerated lower on Tuesday, holding in red for the third straight day and emerged below daily cloud, in which the price was stuck in few previous sessions.

Fresh weakness extended to one-week low at $3.0330 and cracked strong support at 3.0350 (Fibo 61.8% of $2.9370/$3.1935 and opening way for retest of 01 May spike low at $3.0185, to mark full retracement of $3.0185/$3.12 upleg.

The notion is supported by bearish signal on break below daily cloud, with daily close below $3.0350 Fibo support to re-confirm bearish signal.

Moving Averages turned to full bearish setup on daily chart (10/30 bear-cross and 20/200 death-cross are forming), while 14-d momentum is in steep fall and maintains pressure.

Extension below $3.0185 would also complete failure swing pattern on daily chart and unmask key sort-term support at $2.9370 (26 Mar low).

Broken cloud base marks initial barrier at $3.0500, while a cluster of converged MA’s marks strong resistances within $3.0760/$3.0960 zone.

Res: 3.0500; 3.0573; 3.0693; 3.0760

Sup: 3.0330; 3.0185; 3.0000; 2.9975