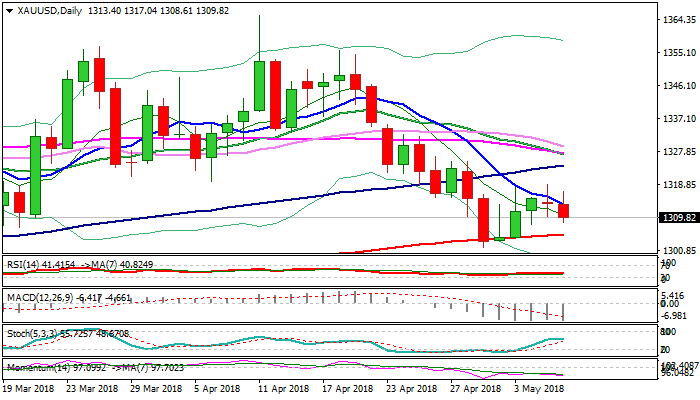

SPOT GOLD eases after recovery stall, risks retest of 200SMA

Gold holds in red on Tuesday as dollar strengthened and eases back to $1308, retracing Fibo 61.8% of $1301/$1918 recovery leg.

Negative near-term bias is establishing after Monday’s long-legged Doji signaled strong indecision and recovery stall, which received confirmation on today’s fresh easing.

Falling 10SMA continues to limit upside attempts despite repeated spikes above and maintaining bearish pressure along with weakening momentum.

Fresh bears off $1318 need close below $1308 to confirm reversal and open way for retest of key support provided by 200SMA ($1305) and renewed probe through psychological $1300 support.

Conversely, eventual close above 10SMA ($1313) would ease downside pressure and signal fresh recovery attempts which need close above $1322 (Fibo 38.2% of $1355/$1301 fall) to spark stronger correction of $1355/$1301 fall.

Res: 1313; 1318; 1322; 1325

Sup: 1308; 1305; 1301; 1295