WTI OIL eases from new highs awaiting US President Trump’s decision on Iran

WTI oil stands at the back foot and returns below $70 handle in early trading on Tuesday, following quick pullback from Monday’s new 3 ½ year high at $70.81.

Traders are cautious ahead of announcement of US President Trump whether the US will pull out of nuclear deal with Iran, made in 2015.

The agreement provided lifting of sanctions on Iran’s oil export in return to stopping its nuclear program.

US decision to withdraw from the deal would hit Iran’s oil exports and tighten oil market, as Iran is the major oil producer in the Middle East, as well as member of OPEC and new sanctions on exports of Iranian oil would signal shortage in the market and lift oil price.

Based on expectations of US withdrawal, current easing could be seen as positioning for fresh rally.

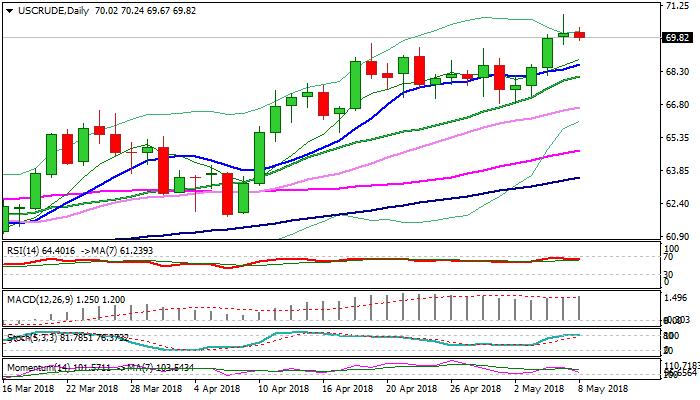

Break and close above $70 mark would be bullish signal for extension towards projections at $72.04 and $73.32 and would expose barriers at $74.94 (04 Oct 2011 low) and $76.35 (Fibo 61.8% of $107.45/$26.04 fall).

If the US stays in the deal, oil price could ease further, as weakening momentum studies maintain near-term pressure, with deeper pullback and stronger close in red today to complete reversal pattern and signal deeper pullback.

President Trump’s announcement would likely overshadow release of API crude stocks data, due later today, which are expected to show the situation with crude inventories which unexpectedly rose strongly last week.

Rising thick hourly cloud (spanned between $69.79 and $68.94) marks strong support and guards pivotal support provided by rising 10SMA ($68.59) loss of which would generate stronger bearish signal.

Res: 70.24; 70.81; 71.21; 71.60

Sup: 69.79; 69.50; 68.94; 68.59