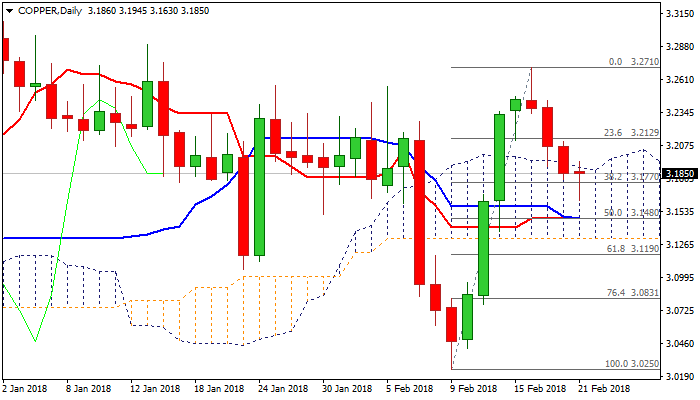

COPPER – bears show hesitation after penetrating daily cloud

Extension of pullback from $3.2710 peak (16 Feb) broke into daily cloud on Wednesday and hit one-week low at $3.1630 (near mid-point of daily cloud, spanned between $3.1895 and $3.1312) where bears were contained by 10SMA.

Subsequent bounce returned above the cluster of daily MA’s (10/20/30, laying between $3.1664 and $3.1768), signaling hesitation.

Near-term action is without clear direction signal as daily techs are mixed (MA’s returned to bullish setup, 14-d momentum is in negative territory, while RSI is in neutral mode).

Stronger dollar keeps the metal under pressure and outcome from FOMC minutes later today would provide fresh signals for the greenback.

Positive signal could be expected on bounce and close above cloud top ($3.1895) and would sideline immediate downside risk.

Otherwise, the downside would remain vulnerable on repeated close within the cloud, with next bearish signal seen on close below cracked $3.1770 support (Fibo 38.2% of $3.0250/$3.2710 rally).

Bearish extension below $3.1480 (converged daily Tenkan-sen/Kijun-sen) is needed to further accelerate bears for attack at daily cloud base ($3.1312) and confirm reversal on break.

Res: 3.1895; 3.1945; 3.2110; 3.2445

Sup: 3.1770; 3.1630; 3.1480; 3.1312