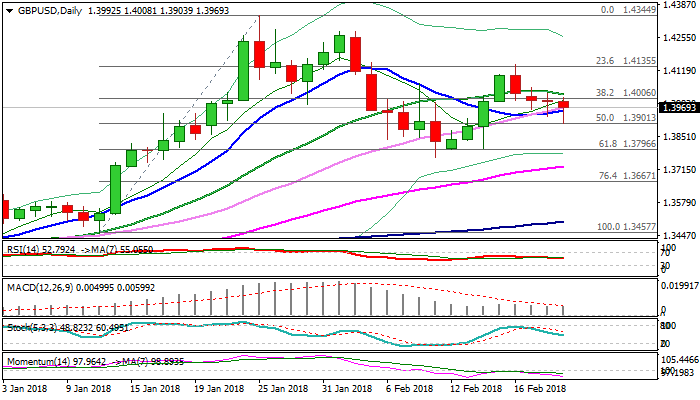

GBPUSD – another downside rejection; range is narrowing ahead of FOMC minutes

Sterling bounced after cracking important support at 1.3909 (Fibo 61.8% of 1.3764/1.4144 upleg) on unexpected rise in UK unemployment but dip was again short-lived, forming another long-tailed daily candle.

However, series of lower highs and lower lows in past few sessions maintain near-term downtrend from 1.4144 (16 Feb lower top), which needs close below repeatedly cracked 10SMA (1.3954) for initial bearish signal and firm break below 1.3900 pivot for confirmation.

Alternative scenario requires close above 20SMA (1.4019) to sideline immediate downside risk.

FOMC minutes may provide stronger signal.

Res: 1.4008; 1.4024; 1.4049; 1.4104

Sup: 1.3954; 1.3931; 1.3904; 1.3854