EURUSD – extended weakness after hawkish Fed minutes exposes key supports at 1.2205/1.2173

The Euro remains in red on Thursday and hit 1 ½ week low at 1.2259 after Fed minutes further inflated the dollar.

Minutes of Fed’s 30/31 Jan policy meeting showed the US policymakers upgraded their forecasts for economic outlook since December and showed more confidence regarding interest rates hikes this year on improved view on inflation.

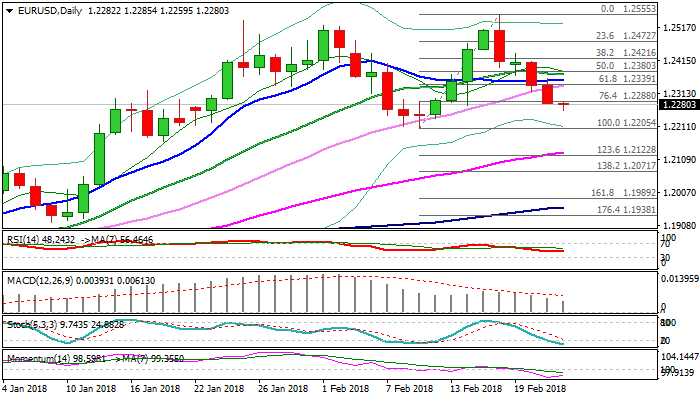

Rising hopes for more rate hikes than initially planned keep the single currency under pressure, as extension below 1.2288 (broken Fibo 76.4% of 1.2205/1.2553 upleg) opens way towards key supports at 1.2205 (09 Feb higher low) and 1.2173 (Fibo 38.2% of Nov/Feb 1.1553/1.2555 ascend).

Violation of these support would generate stronger bearish signal for extension of descend from daily double-top (1.2537/55) towards 1.2132 (rising 55SMA) and 1.2092 (former top of 08 Sep).

Daily techs are maintaining strong bearish momentum and backing further weakness, but oversold slow stochastic warns that bears may take a breather ahead of 1.2205 pivot.

Falling thick hourly cloud (spanned between 1.2330 and 1.2367) weighs on near-term action and is expected to cap upticks, as resistance is reinforced by a cluster of daily MA’s (10/20/30 SMA, laying between 1.2336 and 1.2369).

Release of German Ifo business climate index is the key event in the European session (Feb f/c 117.1 vs Jan 117.6) with softer than expected numbers to further weaken the Euro.

Res: 1.2288; 1.2330; 1.2369; 1.2412

Sup: 1.2259; 1.2235; 1.2205; 1.2172