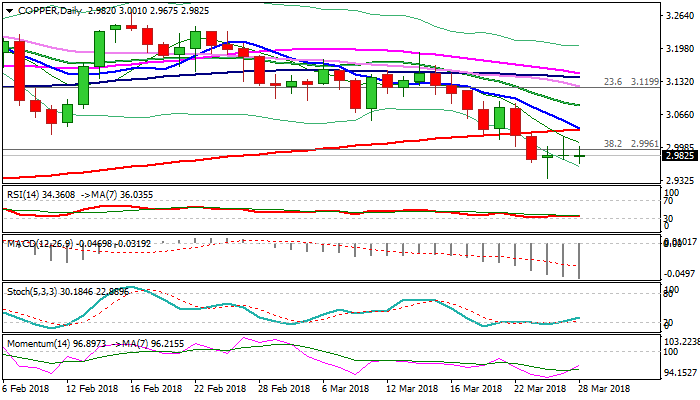

COPPER – the third long legged Doji signals extended directionless mode; overall structure remains firmly bearish

Copper holds in directionless mode for the third straight day after Monday’s downside attempts were strongly rejected at $2.9370 (the lowest since late Sep 2017), but subsequent recovery actions were limited, resulting in double long-legged Dojis on Mon/Tue and Wednesday’s trading holding so far in the same shape.

Situation about current dispute between the USA and China over tariffs on imported goods is unclear, though persisting fears of trade war keep metal’s price at risk of further fall.

The notion is supported by firmly bearish daily studies, with today’s attempts to form 10/200SMA death-cross, expected to further weigh on copper’s price.

Clear break out of current congestion is needed to generate firmer direction signal. Bears need eventual close below cracked key support at $2.9425 (05 Dec low) and break below Monday’s spike low at $2.9370 to confirm bearish continuation, as completion of asymmetric H&S pattern on weekly chart on last week’s break below the neckline was strong bearish signal.

Conversely, bullish scenario needs close above $3.0225/39 pivots (Tuesday’s spike high / Fibo 38.2% of $3.1645/$2.9370 bear-leg) to signal recovery.

Res: 3.0000; 3.0250; 3.0322; 3.0540

Sup: 2.9675; 2.9370; 2.9000; 2.8960