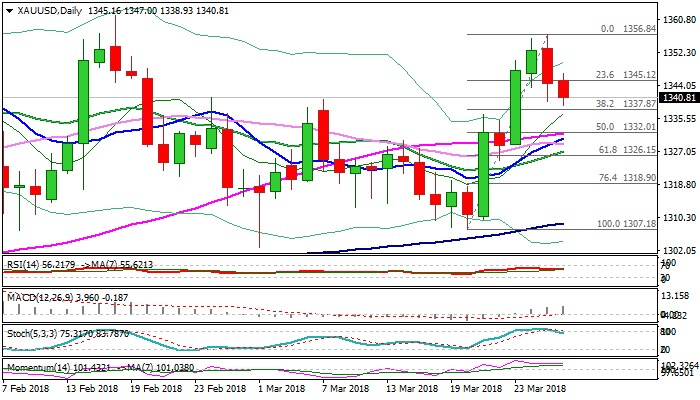

SPOT GOLD – bearish outside day was negative signal; extension of pullback pressures daily cloud top

Spot Gold remains at the back foot on Wednesday and extended pullback from six-week high at $1356, pressuring strong supports at $1337/36 zone (top of thick daily cloud / Fibo 38.2% of $1307/$1356 rally).

Tuesday’s close in red which formed bearish Outside Day weighs, with slow stochastic emerging from overbought territory, adding on pressure for possible deeper correction.

Close below $1337/36 pivots is needed to generate bearish signal for extended pullback.

Plethora of daily MA supports in $1331/27 zone marks next strong support which is expected to contain extended dips and keep larger bulls in play.

Release of US GDP data today is eyed for fresh direction signals.

Res: 1345; 1347; 1350; 1356

Sup: 1336; 1331; 1327; 1325