Corrective bounce likely to precede fresh weakness

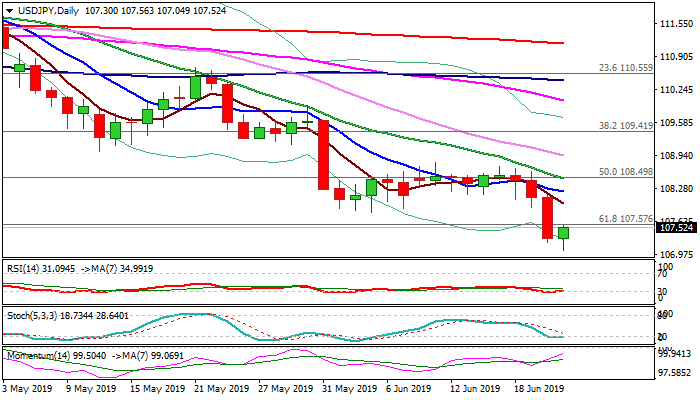

The pair rebounds from new multi-month low at 107.04 on Friday as traders take profits from post-Fed two-day 1.1% fall.

Oversold daily studies support the action which eyes barriers at 107.81/98 (former low of 5 June / falling 5SMA), ahead of descending 10SMA (108.23).

Overall bearish structure favors limited corrective action before bears resume, as the pair is on track for weekly close in red and weekly studies maintain firm bearish tone.

Geopolitical tensions that boost safe-haven demand add to negative outlook.

Bears need weekly close below cracked Fibo support at 107.57 (61.8% of 104.59/112.40) to generate fresh negative signal for probe below 107.04 low and test of 106.43 support (Fibo 76.4%).

Only daily close above 10SMA would delay bears and expose upper pivots at 108.49 (falling 20SMA) and 108.80 (11 June high).

Res: 107.57; 107.81; 107.98; 108.23

Sup: 107.21; 107.04; 106.43; 106.00