Lira advances after opposition victory in Istanbul

The pair opened with gap-lower on Monday and extended weakness to the lowest level in 1 ½ month in early European session trading.

The dollar continues to weaken on Fed’s signal of interest rate cut, while lira was boosted by renewed optimism after opposition candidate won on repeated vote in Istanbul.

Expectations that the government will focus on key economic reforms, inflates lira, while threats of US sanction on Turkey over Russian weapons and CBRT policy dilemma, continue to weigh. Markets turn focus towards end of June G20 Erdogan-Trump meeting, with increased uncertainty expected until then.

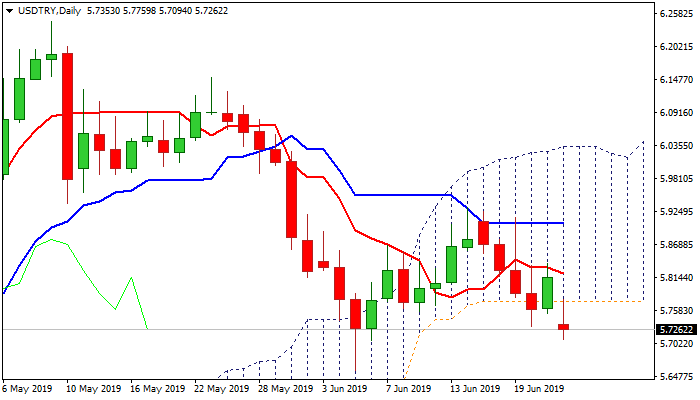

The pair extends weakness below daily cloud base (5.7736), on track to make clear break and attack series of key supports at: 5.6822 (100SMA); 5.6631 (Fibo 61.8% of 5.3037/6.2445) and 5.6102 (200SMA).

Rising bearish momentum and bearish setup of daily MA’s (5;10;20;30) support scenario, but oversold stochastic warns of extended consolidation, however, bearish bias is expected to remain intact as long as the price holds below the base of thick daily cloud.

Res: 5.7736; 5.8122; 5.8283; 5.8851

Sup: 5.7094; 5.6822; 5.6631; 5.6575