Crude oil remains under pressure on expectations of hawkish Fed

The WTI oil hit new two-week low on Wednesday as demand concerns were offset by expectations that the Fed may signal that higher interest rates might be needed.

All eyes are on minutes of Fed’s last policy meeting, due to be released later today, as the central bank will provide more details about its steps in coming months and signal how much further it will need to raise interest rates to bring high inflation under control.

Hawkish rhetoric from Fed would offer fresh boost to already elevated dollar, with signals of extended tightening cycle and further rise of interest rates, to hurt demand and increase pressure on oil prices.

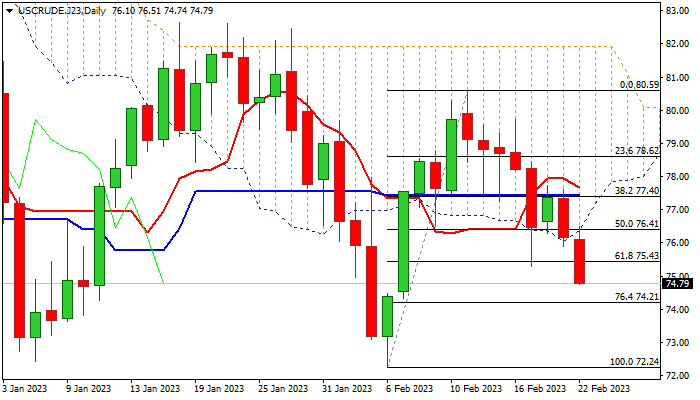

Today’s bearish extension emerged below thick daily cloud and broke below pivotal Fibo support at $75.43 (61.8% of Fibo 76.4% of $72.24/$80.59 upleg), with close below here to confirm bearish signal and open way for further easing.

Daily technical studies are in full bearish setup and contribute to negative outlook.

Bears eye next target at $74.21 (Fibo 76.4%), loss of which would signal extension towards $72.44 (Jan 5 low) and $72.24 (2023 low, posted on Feb 6).

Broken cloud base reverted to solid resistance, which should cap upticks keep bears in play.

Res: 75.43; 76.41; 77.18; 77.40

Sup: 74.21; 72.44; 72.24; 70.09