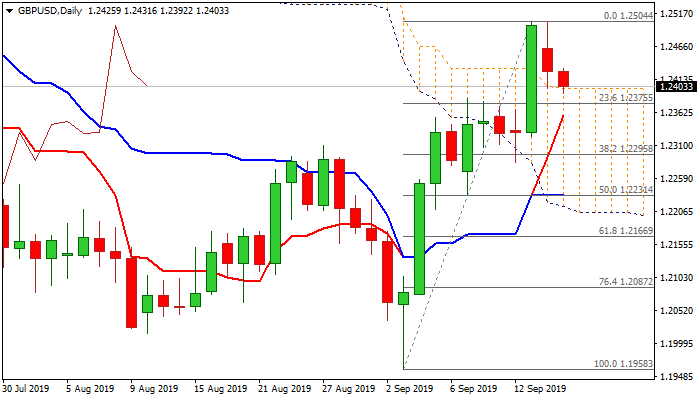

Daily cloud top holds for now but deeper pullback cannot be ruled out

Pullback from strong barrier 1.2501 (Fibo 38.2% of 1.3381/1.1958, reinforced by falling 100DMA, where double upside rejection occurred) extends into second day and probes through strong support, provided by daily cloud top (1.2399).

The pair lost traction after repeated upside failure and traders booked profits from Friday’s 1.36% advance.

Near-term sentiment also soured Monday’s meeting between UK PM Johnson and top EU officials, as Johnson was optimistic, while EU said that there was no improvement as Johnson did not provide any new idea in order to break existing Brexit deadlock.

Daily techs favor further easing, as stochastic emerged from overbought zone after forming bearish divergence and RSI turns south, but bullish momentum remains strong.

Penetration of daily cloud would signal deeper pullback and expose rising 10DMA (1.2354) and top of thick 4-hr cloud (1.2325) which guard pivots at 1.2298/95 (55DMA / Fibo 38.2% of 1.1958/1.2504).

Holding above cloud top would keep bullish bias for renewed attempts towards key 1.2500 resistance zone.

Res: 1.2431; 1.2459; 1.2501; 1.2558

Sup: 1.2392; 1.2354; 1.2323; 1.2295