Daily cloud twist continues to attract bulls

The Euro is holding firm tone on Tuesday morning and extending advance into fourth straight day.

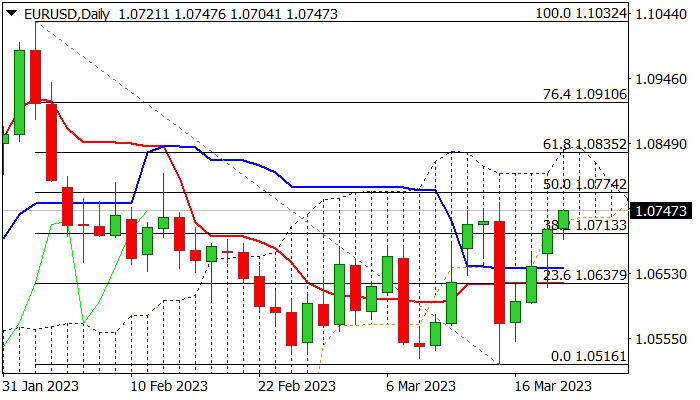

Near-term action continues to advance along with rising daily Ichimoku cloud base, as the cloud twists next week (1.0758) and attracts bulls.

Bullish daily studies contribute to positive near-term outlook, as bulls broke through pivotal Fibo barrier at 1.0718 (38.2% of 1.1032/1.0516 descend) and pressure next key resistance at 1.0759 (Mar 15 high / top of the recent range.

Firm break here is needed to signal an end of a month-long sideways trading and confirm a higher base at 1.0520 zone (lows of Mar 8,15), which would open way for further recovery of 1.1032/1.0516 pullback.

Converged and parallel-running daily Kijun-sen and Tenkan-sen (although still in bearish configuration) offer supports.

Kijun-sen (1.0660) should contain dips to keep bulls in play, while drop and close below Tenkan-sen (1.0637) would weaken near-term structure and shift immediate focus to the downside.

Markets await today’s key releases (German / EU ZEW Economic sentiment) for fresh signals, as both indicators are forecasted to show significantly lower values in March in comparison to February)

Res: 1.0759; 1.0778; 1.0838; 1.0874

Sup: 1.0704; 1.0660; 1.0637; 1.0585