Deflated Aussie attacks key support

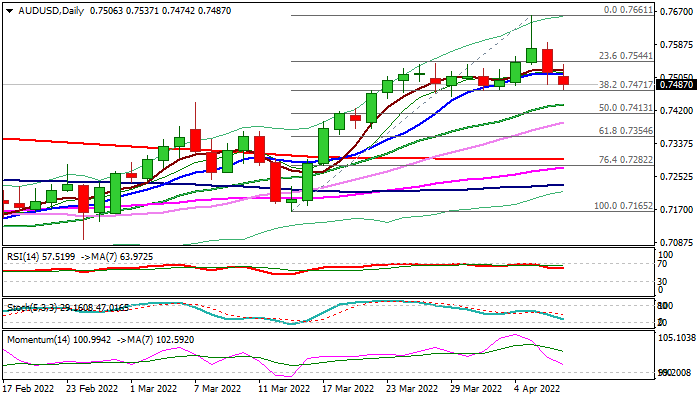

The Australian dollar extends steep pullback from 10-month high (0.7661, Apr 5) and pressuring key support at 0.7471 (Fibo 38.2% of 0.7165/0.7661 upleg), where a number of attacks in past two weeks failed.

The Aussie is weighed by lower commodity prices and fading risk mode, threatening break of 0.7471 pivot that would signal a top and open way for deeper drop towards supports at 0.7413 and 0.7354 (Fibo 50% and 61.8% of 0.7165/0.7661).

Daily close below cracked converged 10/20 DMA’s (0.7512/16) would add to weakening daily studies which rapidly lose negative momentum.

Tuesday’s inverted hammer on a daily chart, weekly Doji with very long upper shadow and monthly Gravestone Doji candle, contribute to negative signals.

Res: 0.7500; 0.7544; 0.7593; 0.7661

Sup: 0.7471; 0.7436; 0.7413; 0.7390