Directionless mode after Brexit / Fed eyes G20 meeting for fresh signals

Cable trades in narrow-range directionless mode on Friday and holding within larger range which extends into third straight week and on track to end the third week in Doji candle.

Quiet mode comes after bumpy ride in past three days, driven by news from Brexit and Fed, with focus turning towards G20 meeting over the weekend, which could be a catalyst.

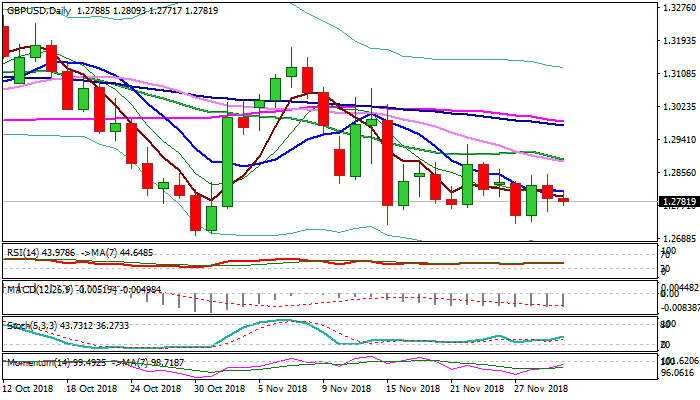

Daily techs show mixed signals as MA’s remain in bearish setup while momentum is strengthening.

Initial bullish signal could be expected on sustained break above 10SMA (1.2807) which would open 1.2850 (tops of Thu/Wed) but stronger bullish signal could be expected on firm break above range top at 1.2927.

Conversely, eventual break below 1.2722/25 lows, where near-term base is forming, would generate initial bearish signal and expose key supports at 1.2695 (30Oct low) and 1.2661 (2018 low).

Res: 1.2807; 1.2849; 1.2889; 1.2927

Sup: 1.2755; 1.2722; 1.2695; 1.2661