Dollar eyes FOMC minutes for fresh direction signal

The dollar index rose in in early trading on Wednesday, recovering losses from the previous day, driven by drop in global bond yields, as traders await release of FOMC minutes (due later today) for fresh signals.

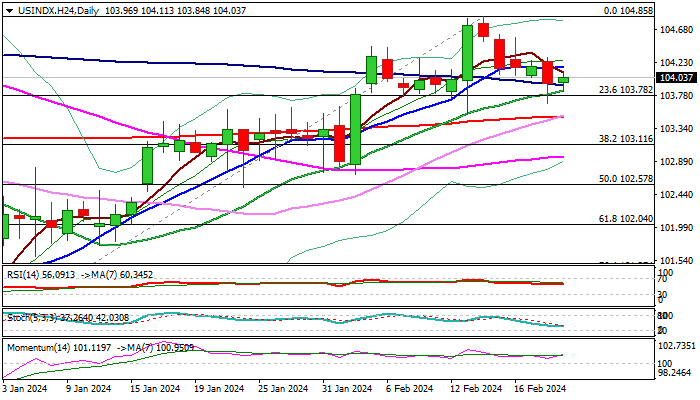

Pullback from new three-month high (104.85) found solid ground at 103.80 zone (Fibo 23.6% of 100.29/104.85 / converging descending 100 and rising 20DMA’s) and was strongly rejected here (Tuesday’s daily candle with long tail), forming a bear-trap pattern below Fibo support.

Bullish technical picture on daily chart (strengthening positive momentum / bullish setup of MA’s) supports the idea of a healthy correction before larger bulls resume.

Close above 10DMA (104.17) is a minimum requirement for fresh bulls to keep traction for further recovery.

FOMC minutes are expected to provide more clues about Fed’s action in coming months, as market expectations that the central bank will leave rates unchanged in the next two policy meetings are rising and fading expectations for early start of rate cuts.

On the other hand, the latest inflation report showed fresh rise in consumer prices and Fed’s reaction to this is going to be very important.

Hawkish stance of the US policymakers which means that rates will remain unchanged and provide no clear signals of the time of start of policy easing, will be supportive for the dollar, while the greenback may come under increased pressure if the Fed sees the latest rise in inflation as temporary phenomenon and proceeds with plans for rate cuts in the near future.

Res: 104.17; 104.42; 104.56; 104.85

Sup: 103.92; 103.78; 103.50; 103.11