Dollar firms as upbeat growth expectation improve the sentiment despite Fed’s dovish stance

The dollar kept firm tone against the basket of major currencies on Friday, following previous day’s rebound that almost fully reversed Wednesday’s post-Fed fall.

Investors digested Fed’s dovish stance on decision to keep ultra-low rates but central bank’s pledge to press on with aggressive stimulus and projections for the strongest economic growth in nearly a four decades, improved the sentiment and lifted the greenback.

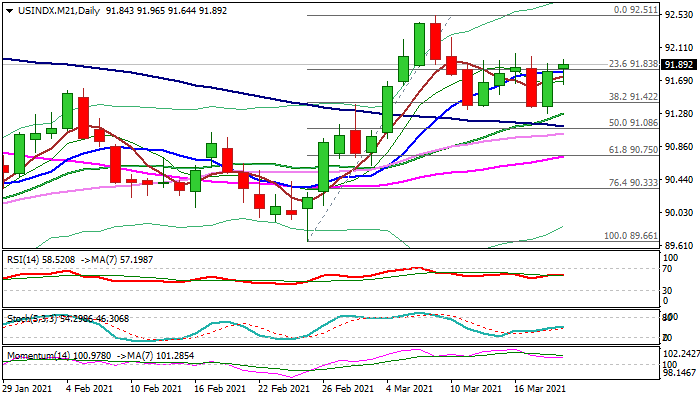

Fresh strengths pressure the upper boundary of two-week congestion after dips were contained in the zone of strong Fibo support (38.2% of 89.66/92.51 upleg) and formed a higher base at 91.30 zone, with subsequent bounce from this base signaling that the pullback from 92.51 (March 9 high) might be over.

Fresh bulls need close above 92 barrier (congestion top / Fibo 61.8% of 92.51/91.27 pullback) to confirm reversal.

The notion is supported by bullish daily studies and expectations for bullish weekly close and over a quarter percent gain over the week.

Today’s close (the second consecutive) above 10DMA (91.79) would confirm bullish near-term stance.

Res: 92.02; 92.21; 92.42; 92.51

Sup: 91.79; 91.64; 91.42; 91.27