Dollar index – bulls regained control after hotter than expected US January inflation

The dollar index is trading near three-month high in early Wednesday, following sharp rise (0.7%) on Tuesday, sparked by higher than expected US January inflation, which cooled bets for the first Fed rate cut.

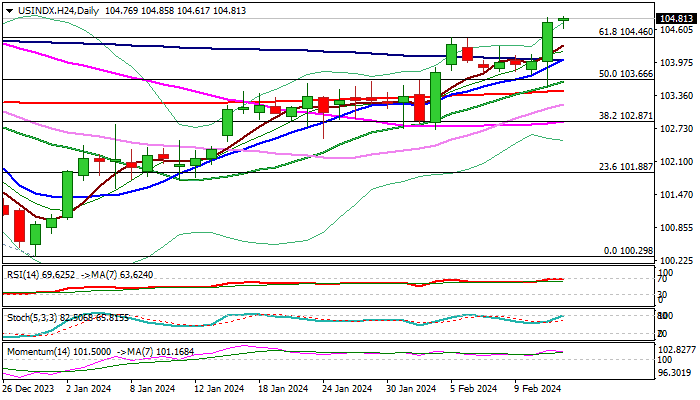

Fresh advance generated bullish signals on break above near-term consolidation range and close above pivotal Fibo barrier at 104.46 (61.8% retracement of 107.03/100.29 downtrend).

Daily studies improved further, as positive momentum remains strong and rising moving averages created several bull-crosses, underpinning the action.

Bulls eye targets at 105.00/44 (psychological / Fibo 76.4%) though overbought conditions may prompt traders to collect some profits and position for fresh push higher.

Broken Fibo 61.8%, also former tops of Feb 5/6 (104.46) reverted to solid support, followed by converged 10/100DMA’s (104.02) which should contain dips and provide better buying opportunities.

Broken 20 and 200DMA’s (103.62/45) mark lower pivots, loss of which will be bearish.

Res: 105.14; 105.44; 105.87; 106.55

Sup: 104.46; 104.24; 104.02; 103.62