Dollar index eyes Fed decision for fresh direction signals

A quick change in sentiment pushed the dollar index price to the lowest of the week in European trading on Friday, after it hit weekly high on Thursday afternoon, just ahead the US data which deflated the dollar.

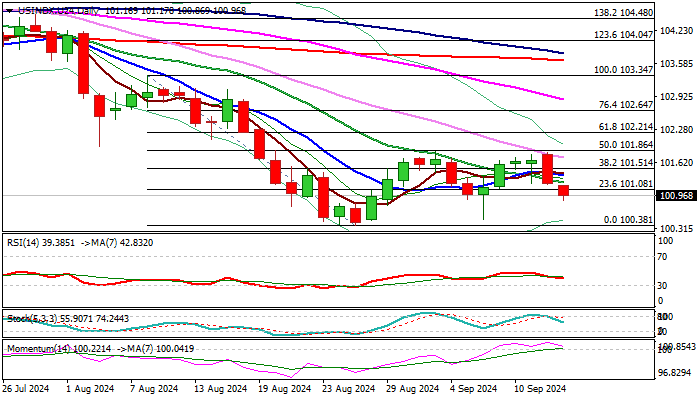

The price action has been in a sideways mode in past couple of weeks and moving above new one-year low and 200WMA, as markets await Fed policy meeting next week to get more clues about dollar’s direction.

The Fed is likely to start cutting interest rates in its monetary policy meeting next week, but it is still unclear what will be the size of rate cut as bets for either cut (25 or 50 basis points) continue to rise and decline, according to incoming economic data.

The dollar is expected to fall if US policymakers opt for more aggressive scenario, with violation of pivotal supports at 100.30/00 (200WMA / psychological) to expose targets at 99.20/98.92 (17 July 2023 low / Fibo 61.8% of 89.15/114.72 uptrend).

On the other hand, the currency may rise if the central bank disappoint markets by decision for 25 basis points rate cut however, sustained break above the top of recent range (101.85) will be required to bring bulls back to play.

Res: 101.22; 101.50; 101.86; 102.21

Sup: 100.86 100.49; 100.30; 100.00