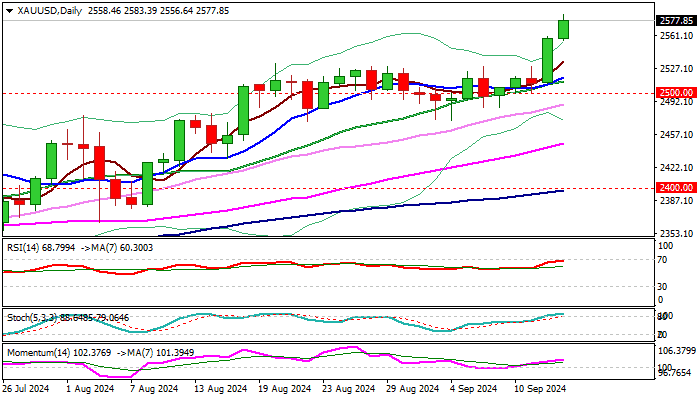

Gold extends its sharp rally into uncharted territory and approaches $2600 target

Gold continued to trend higher on Friday and hit new all-time highs, being the top performer in the market for the second consecutive day and on track for a weekly gain of around 3.3%.

Fresh acceleration higher was sparked by almost certain Fed rate cut next week, with renewed rise in expectations for more aggressive 50 basis points cut, adding to strong bullish sentiment.

Bullish technical studies contribute to favorable fundamentals, with psychological $2600 barrier coming in focus.

Meanwhile, the price may ease on profit taking as many traders prefer to close their positions at the end of the week, with overbought conditions on daily and weekly chart supporting the notion.

Dips should be shallow, as the price gained strong positive momentum and near-term sentiment is very bullish and should provide better levels to re-enter bullish market.

Session low ($2556) marks initial support, with former consolidation range ceiling ($2531) now acting as solid support, expected to contain corrective dips and guard lower pivots at $2500/$2480.

Weekly close above $2531 to confirm signal of continuation of larger uptrend.

Res: 2591; 2600; 2614; 2628

Sup: 2556; 2531; 2528; 2517