USDJPY falls to the lowest in over one year after violation of key supports

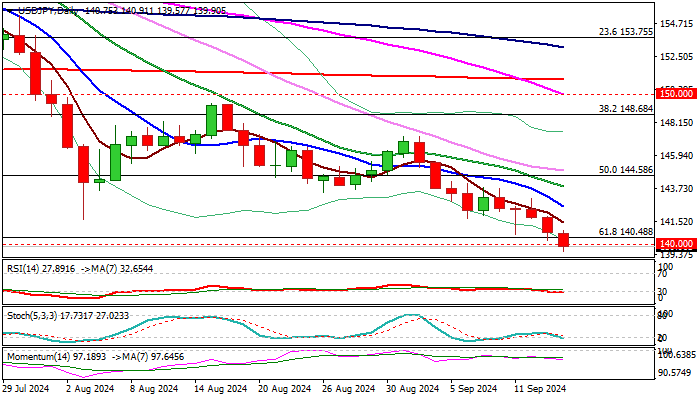

USDJPY fell to the lowest levels since July 2023 in early Monday trading as fresh acceleration lower broke pivotal supports at 140.77 (weekly cloud base) and 140.48/25 (Fibo 61.8% of 127.22/161.95 rally / Dec 28 low) and moved below psychological 140 support.

The dollar remains under pressure on firm expectations for Fed rate cut this week, with widely expected decision for 25 basis points cut however, more aggressive action for 50 basis points cut is still on the table and adds pressure on dollar.

On the other hand, signals that come from Japanese policymakers for further rate hikes (although the BoJ is expected to stay on hold in the policy meeting on Friday) fuel the story of widening gap between monetary policies of two central banks and provide fresh boost to Japanese yen.

Technical studies are firmly bearish on daily and weekly chart, suggesting that the pair may continue to travel south.

Daily close below 140 handle is needed to confirm signal and expose targets at 137.23 (July 2023 low) and 135.41 (Fibo 76.4%) in extension.

Meanwhile, oversold conditions on daily chart may provide fresh headwinds to larger bears, with consolidation / limited correction to mark positioning for fresh push lower.

Broken weekly cloud base reverted to solid resistance (141.15), followed by falling daily Tenkan-sen (142.56) which should ideally cap upticks.

Res: 140.00; 140.48; 141.15; 141.76;

Sup: 139.00; 138.06; 137.23; 135.41