Euro rises further on weaker dollar

EURUSD rises for the third straight day, benefiting from weaker dollar on speculations of the magnitude of Fed’s rate cut on Wednesday.

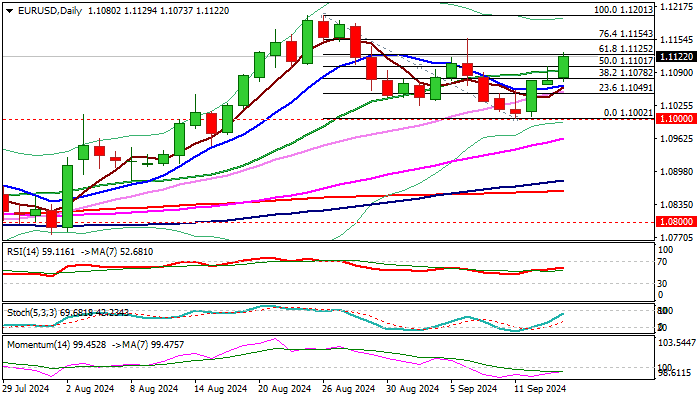

Recovery leg from a higher base (formed after a double rejection just above psychological 1.10 support) retraced so far 61.8% of 1.1201/1.1002 pullback, adding to upside prospects.

Improved picture on daily chart (MA’s returned to bullish setup / RSI continues to head north above neutrality territory) supports the notion however, ascending 14-d momentum is still in negative territory and warning of potential recovery stall.

Daily close above Fibo 61.8% (1.1125) is needed to generate fresh bullish signal for attack at 1.1154 (Fibo 76.4% / Sep 6 spike high) break of which to neutralize downside risk and open way for full retracement of 1.1201/1.1002 correction.

Caution on failure at 1.1125 and return below 20DMA (1.1092) which would weaken near-term structure.

Res: 1.1129; 1.1154; 1.1184; 1.1201

Sup: 1.1101; 1.1092; 1.1065; 1.1049