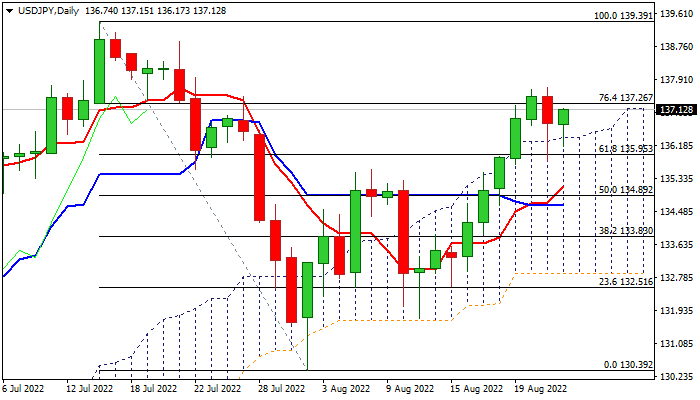

Dollar keeps firm tone above daily cloud

The USDJPY holds firm tone despite the most recent double-rejection at 137.70 zone (upper 20-d Bollinger band) as subsequent dips were contained by the top of thick daily cloud, keeping near-term action within narrow consolidation.

Bullish daily techs (strong positive momentum / daily Tenkan-sen/Kijun-sen bull-cross / MA’s in bullish setup / daily cloud) support the action for final push towards 2022 high at 139.39 (24-year high), but the action may hold in extended consolidation, as markets await fresh signals from Fed Chair Powell’s speech in Jackson Hole symposium.

Although Powell is widely expected to confirm Fed’s readiness to use all available tools to bring soaring inflation under control, investors look for more clues about the Fed’s stance in the near future, to learn whether the central bank is going to maintain aggressive stance or it would reduce the pace of rate hikes and act according to the latest economic data that would directly impact dollar’s performance.

Res: 137.26; 137.70; 138.87; 139.39

Sup: 136.40; 135.81; 135.51; 134.89