Dollar keeps soft tone ahead of Fed

The dollar holds in red on Wednesday (down 0.3% since opening in Asia) weighed down by strength of index’s main components – Euro, British pound and yen.

Market focuses on today’s verdict from Fed, with wide expectations for no rate change, raising worries of central bank’s dovish stance that would further deflate dollar.

Stalled congressional talks about the new package of fiscal support and rising coronavirus cases that threaten to further slow economic recovery, along with retail sales figure for August falling below expectations, add to the factors that negatively impact the greenback.

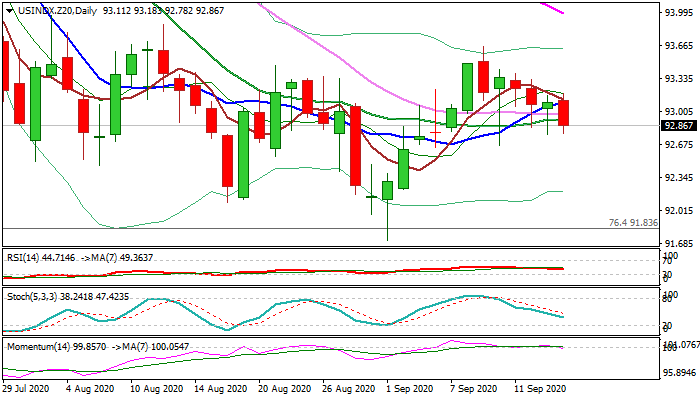

Technical studies on daily chart are in bearish setup (momentum broke into negative territory, fresh weakness slipped below moving averages stochastic and RSI are heading south) and support near-term bears.

Break below 92.66 pivot (50% retracement of 91.71/93.65 recovery / 10 Sep spike low) would generate strong bearish signal for extension of bear-leg from 93.65 (9 Sep correction high).

Major technical support lays at 91.83 (Fibo 76.4% of 2018/2020 88.14/103.80 ascend) and only firm break here would bring larger bears from 2020 peak (103.80) fully in play and risk stronger bearish acceleration.

Res: 92.91; 93.18; 93.42; 93.65

Sup: 92.66; 92.45; 92.17; 91.83