Dollar keeps weak tone, boosting fears of reversal

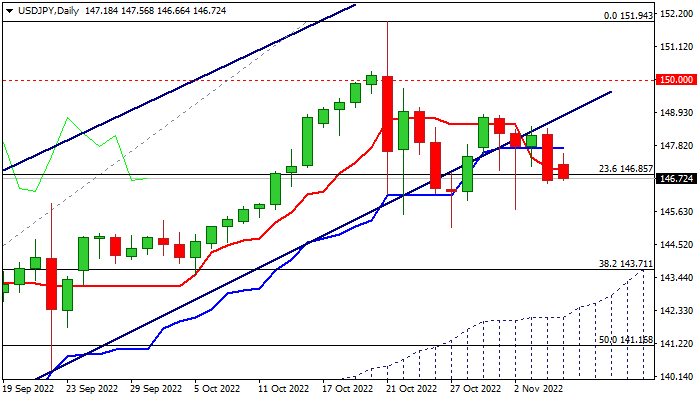

The dollar turns to red in early Europe after initial gains in Asia on Monday and probes again through cracked Fibo support at 146.85 (23.6% of 130.39/151.94 ascend).

Renewed risk sentiment keeps the dollar under pressure, as traders focus on the US mid-term elections and prepare for the likely scenario in which Republicans would take control of Congress and possibly the Senate that would result in a split government.

The risk appetite is likely to remain, according the scenario of potential political gridlock, as markets performed positively after the previous mid-term elections.

Fresh weakness broke again below the trendline support of a larger bull-channel that raises fears of reversal.

Repeated close below Fibo support at 146.85 to generate initial bullish signal, with extension and break below 145.10 pivot (Oct 27 trough) to boost negative signal on completion of failure swing pattern on daily chart.

Daily Tenkan-sen and Kijun-sen turned to bearish setup and structure is weakening on rising negative momentum, adding to signals that near-term focus is shifting lower.

Repeated close below broken daily Kijun-sen (147.73) to keep bearish stance intact.

Res: 147.10; 147.73; 148.52; 148.84

Sup: 146.55; 145.67; 145.10; 143.71