Euro remains firm after Friday’s 2.1% advance on renewed risk appetite

The Euro keeps firm tone at the beginning of the week and consolidating after 2.1% rally on Friday (the biggest daily advance in six years), sparked by renewed risk appetite on speculations that China could soon end its Covid restrictions, but the story was short-lived after China said on Monday that easing of zero-Covid policy is unlikely in the near future.

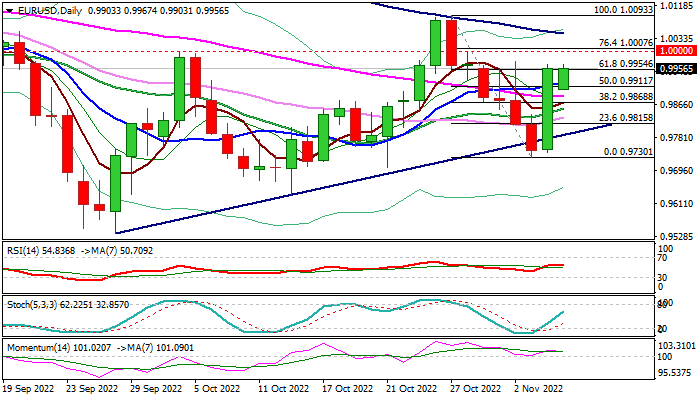

Friday’s strong rally generated bullish signal on marginal close above thick daily cloud (cloud top at 0.9954 is reinforced by Fibo 61.8% of 1.0093/0.9730 bear-leg) but the signal requires confirmation on sustained break above cloud top that would open way for test of parity level and falling 100DMA (1.0046) in extension.

Bullish configuration of daily studies supports the action, which needs to remain above broken 10DMA / 50% retracement of 1.0093/0.9730, to keep bullish bias.

Res: 0.9976; 1.0000; 1.0046; 1.0093

Sup: 0.9954; 0.9911; 0.9886; 0.9855