Dollar loses ground after NFP miss

The dollar index was sharply down after disappointing US labor report, hitting the lowest in six weeks and falling around 1.8% in early US session on Friday, on track for the biggest daily loss since 10 Nov 2022.

NFP miss and higher unemployment add to concerns that the US labor market is losing traction and gives strong signal for the central bank that the rate hiking campaign is coming to its end, as high borrowing cost started to crack labor sector, which was until now quite resilient.

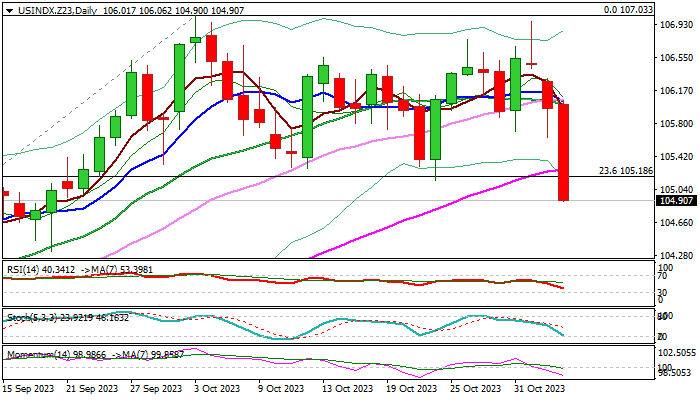

Fresh weakness broke below very important support at 105.18 (Fibo 23.6% of 99.20/107.03 rally / recent range floor) and penetrated rising thick daily Ichimoku cloud (top of the cloud lays at 105.05) with sustained break here to generate initial signal of reversal and a double-top and open way for deeper pullback.

Weakening technical studies on daily chart (rising negative momentum / 10/20/55 DMA’s turned to bearish setup) contribute to fresh negative outlook, though with weekly close below cracked pivotal supports required to verify signal.

Res: 105.18; 105.63; 106.06; 106.31

Sup: 104.32; 104.04; 103.72; 103.27