Euro keeps firm tone and looks for extension of Friday’s 1% advance

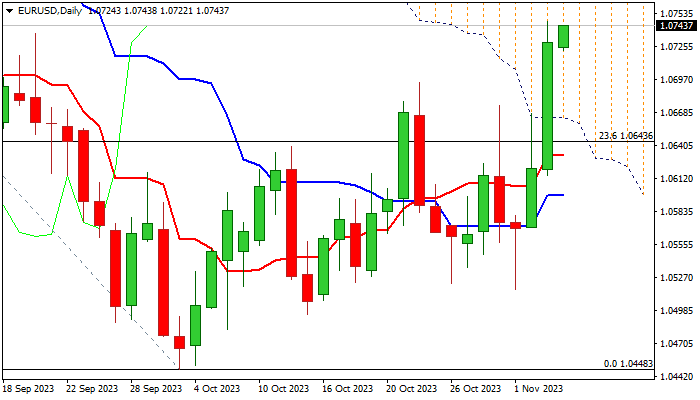

EURUSD is consolidating Friday’s 1.03% advance (the biggest daily rally since July 12) but keeping firm bullish tone for further advance.

Soft US jobs data and less hawkish Fed deflated the US dollar, lifting the Euro to the highest levels since mid-September.

Weekly close above psychological 1.07 barrier generated initial bullish signal, as Friday’s large bullish daily candle also underpins the action for attack at next pivotal resistance at 1.0764 (Fibo 38.2% of 1.1275/1.0448), break of which to expose targets at 1.0799/1.0804 (top of thick falling daily Ichimoku cloud / converged 100/200DMA’s) and 1.0862 (Fibo 50% retracement).

Daily MA’s (10/20/55) are in bullish configuration and positive momentum is strong, though overbought conditions warn that bulls may face headwinds.

Broken 1.07 level reverted to support which should ideally contain dips and guard lower pivot at 1.0653 (55DMA).

Res: 1.0764; 1.0799; 1.0804; 1.0862

Sup: 1.0722; 1.0700; 1.0674; 1.0653