Dollar remains firm on hawkish signals from Fed

The dollar rallies for the sixth consecutive day, hitting a two-week high on Thursday, after receiving fresh support from hawkish Fed.

The US central bank acted in line with expectations and raised interest rates by 0.75% for the fourth straight time, but more important were the signals about the next steps, with comments from Fed Chair Jerome Powell that the battle against inflation will require borrowing costs to rise further, seen as hawkish signals.

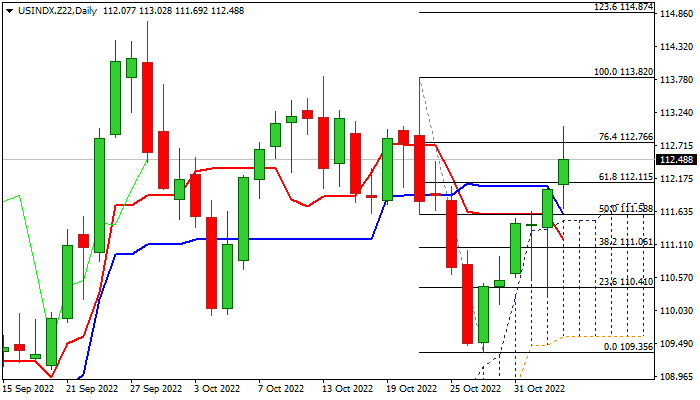

Six-day rally from 109.35/45 double-bottom, where bears were also trapped under pivotal Fibo support, retraced over 76.4% of 113.82/109.35 bear-leg and cracked 113 barrier, but started to lese traction, as daily stochastic is strongly overbought and momentum indicator stalled just ahead of the border line of positive territory.

Overall structure remains bullish and consolidation above daily cloud top (111.50) which marks significant support, is likely to precede fresh advance towards 113.82/83 double-top and key barrier at 114.72 (2022 peak, the highest since 2002)

Res: 113.02; 113.83; 113.98; 114.87

Sup: 112.16; 110.62; 111.19; 110.75