Dollar remains firmly in red despite weak US jobs report

The dollar kept bearish tone despite much weaker than expected US non-farm payrolls report that was expected to depress the risk mode and lift safe-haven greenback.

Investors remained cautiously optimistic and assuming that weak labor data won’t significantly hurt overall economic recovery, even though many economists downgraded their estimations for Q3 GDP due to worsening health situation and persisting supply issues.

The dollar index remains firmly in red for the fourth straight day and on track for the second consecutive strong weekly loss.

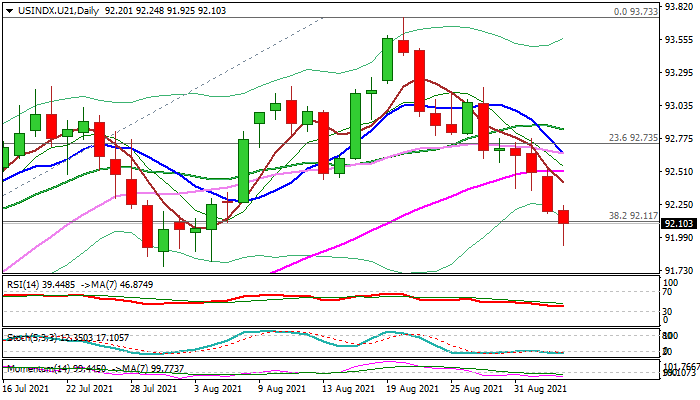

Near-term action is holding deeply in the thick daily cloud and cracked pivotal Fibo support at 92.11 (38.2% of 89.50/93.73) with weekly close below here to add to negative signals and risk extension towards 91.80 higher base, Fibo 50% / 100DMA at 91.50 and key supports at 91.34 / 32 (daily cloud base / 200DMA).

Daily studies in bearish setup and weakening conditions on weekly chart, add to negative outlook.

Corrective upticks should be ideally capped by daily cloud top (92.40).

Res: 92.24; 92.40; 92.55; 92.75

Sup: 91.80; 91.50; 91.32; 91.11