Dollar takes a breather but remains robust as Fed stays on aggressive path

The dollar index edged higher in European trading on Friday, regaining traction after Thursday’s 0.7% drop.

Unexpected drop was sparked by revived risk appetite, despite the latest report showed US inflation rose above expectations in September that adds to expectations for another aggressive action from Fed in the next policy meeting.

Markets widely expect another 0.75% hike, which will be the fourth in a row, with conditions of persisting red-hot inflation, keeping in play the bets for possible 1% rate hike, although the expectations for such action are so far only at 10%.

From the fundamental side, the overall situation remains very supportive for the dollar, as increased safe-haven flows on global political and economic uncertainty continue to inflate the currency.

In addition, revised view for the US monetary policy signals that the Fed is likely to increase the size and pace of tightening and that interest rate would top at 5% by March 2023, overshooting the latest forecasts.

The cocktail of positive factors leaves a little space for a deeper correction, although some price adjustments can not be ruled out.

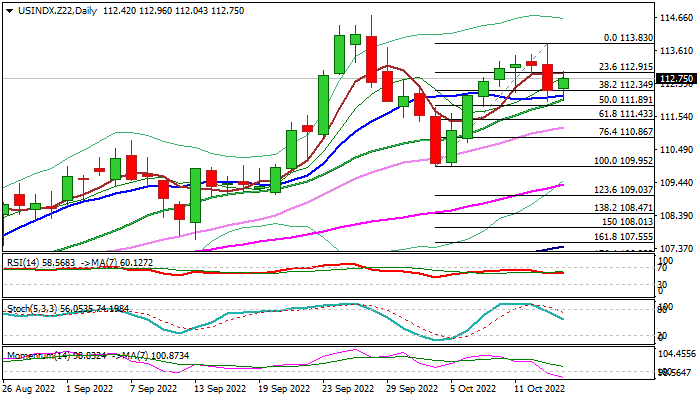

The picture on daily chart is mixed as 14-d momentum is in negative territory and heading south, but moving averages are in full bullish setup.

Immediate supports lay at 112.34 / 19 (Fibo 38.2% of 109.95/113.83 upleg / 10DMA) and so far keep the downside protected.

Break here would risk test of next pivot at 111.89 (50% retracement, reinforced by daily Tenkan-sen), loss of which would weaken near-term structure and allow for deeper pullback towards 111.43/18 (Fibo 61.8% / daily Kijun-sen).

Conversely, weekly close above 10 DMA would keep in play hopes for renewed attack at Thursday’s post-CPI data peak (113.83) and unmask key barrier at 114.72 (20-year high posted on Sep 28) on break.

Res: 112.96; 113.83; 114.42; 114.72

Sup: 112.34; 112.19; 111.89; 111.43