Dovish Fed and safe-haven buying underpin gold price

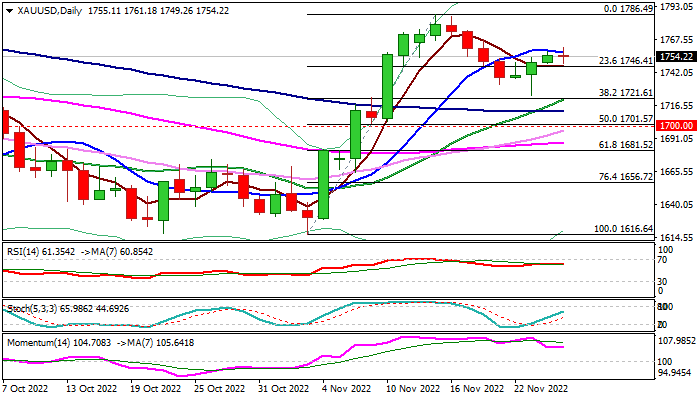

Gold price edges lower in European trading on Friday, after the action repeatedly failed at 10DMA ($1756), with daily techs remaining bullishly aligned after a pullback from Nov 15 peak ($1786) found firm ground just above pivotal Fibo support (38.2% of $1616/$1786), reinforced by rising 20DMA.

The metal is on track for a marginal weekly gains that would partially offset negative signal from previous week’s bearish candle with long upper shadow, with more positive signals from monthly performance, as the yellow metal advanced strongly in December and on track for the first bullish monthly close after seven straight months in red ( November’s rally marks so far the biggest rally since May 2021).

Initial support at $1746 (cracked Fibo 23.6% / 5DMA) should ideally hold, however, deeper dips should not exceed key supports at $1721, to keep near-term bulls in play.

Res: 1762; 1771; 1786; 1800

Sup: 1746; 1732; 1721; 1712