Downbeat US data inflate Euro ahead of Fed

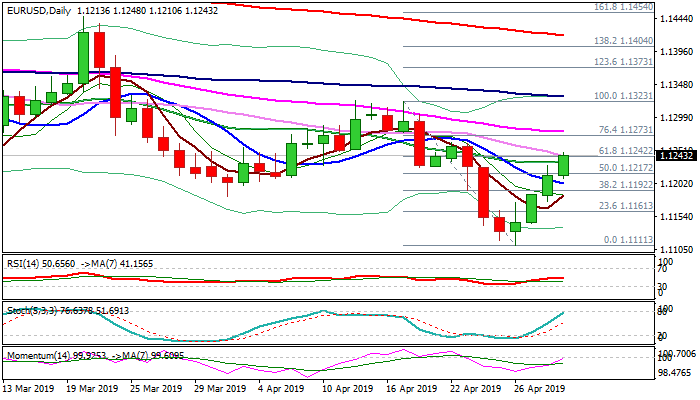

The Euro advanced further and cracked pivotal barrier at 1.1242 (Fibo 61.8% of 1.1323/1.1111 / falling 30SMA) as dollar was hurt by downbeat US data (Manufacturing PMI Apr 52.8 vs 55 f/c; Construction spending Mar -0.9% vs 0.3% f/c) which offset positive impact from strong results from US private jobs sector data (Apr 275K vs 181K f/c).

Traders focus Fed monetary policy decision which could further weaken the greenback if the central bank softens the tone that is widely expected.

Close above 1.1242 pivot would risk test of 55SMA (1.1279) and expose key barriers at 1.1323/28 (12/17 Apr highs / daily cloud base).

Broken 20SMA/ 4-hr cloud top mark initial supports at 1.1234/21, guarding lower pivot at 1.1202 (10SMA).

Res: 1.1248; 1.1279; 1.1303; 1.1323

Sup: 1.1234; 1.1221; 1.1202; 1.1192