Euro bulls on hold after steady Fed

The Euro holds within narrow consolidation in early Thursday’s trading following strong post-Fed dip on Wednesday.

The US central bank kept steady course, disappointing those who expected dovish steer, as initial signal on downgraded inflation outlook, being quickly offset by comments from Jerome Powell, who described the factors that drag inflation as transitory and saw no reasons for rate move in either direction.

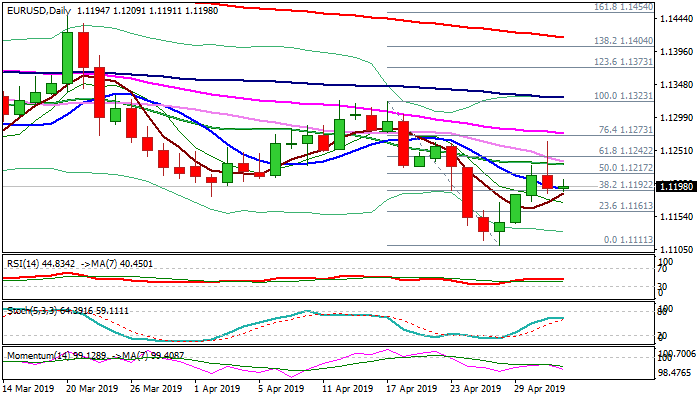

Long upper shadow of Wednesday’s daily candle, left after strong upside rejection from new 2 ½ week high at 1.1264 and close below cracked important barriers (10/20/30SMA’s / Fibo 61.8% of 1.1323/1.1111) suggests that recovery might be over.

Strengthening bearish momentum on daily chart adds to negative outlook, which needs repeated close below 10SMA (1.1195) for confirmation.

Only return and close above 1.1242 Fibo barrier would neutralize bearish threats.

German Manufacturing PMI (Apr 44.5f/c vs 44.5 prev) is the key event of European session, with BoE policy meeting and US jobless claims also eyed for fresh signals.

Res: 1.1209; 1.1235; 1.1242; 1.1264

Sup: 1.1188; 1.1170; 1.1147; 1.1111