EURCHF falls to new multi-year low on signals of early ECB rate cuts

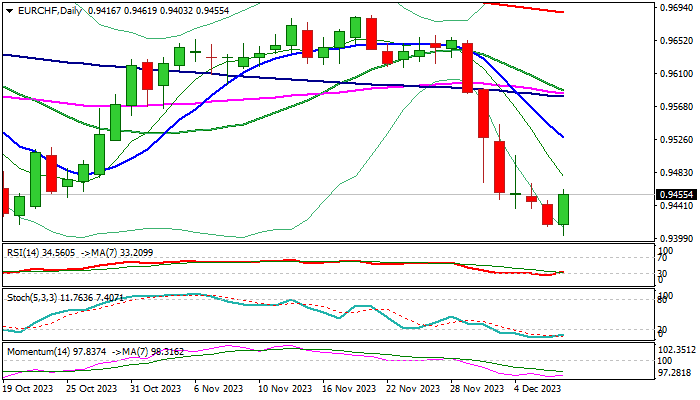

EURCHF hit new multi-year low on Thursday, in extension of steep fall from a double-top at 0.9680 zone (tops of Nov 14/21).

The pair was deflated by growing expectations for more aggressive rate cuts by the ECB next year, while the Swiss National Bank is expected to leave interest rates unchanged at 1.75% in the policy meeting next week.

The price stayed at new lows for a short period, as traders started to collect profits from strong supports at 0.9400 zone (late Sep 2022 low).

Quick bounce was also boosted by deeply oversold conditions on daily chart, but the action so far looks as corrective and likely to provide better selling opportunities for renewed attack at key 0.9400 zone, violation of which would expose key longer term support at 0.9000 zone (Jan 2015 spike low / psychological).

Daily studies show room for further upside, with solid barriers at 0.0.9510/28 (Fibo 38.2% of 0.9684/01.9403 / falling 10DMA) expected to ideally cap and mark a healthy correction, before larger bears regain control.

Res: 0.9465; 0.9510; 0.9528; 0.9544

Sup: 0.9403; 0.9354; 0.9315; 0.9252