EURJPY – the biggest daily fall since mid-2016

The cross collapsed on Tuesday, following BOJ’s surprise, falling by 3.3%, in the biggest daily loss since 24 June 2016.

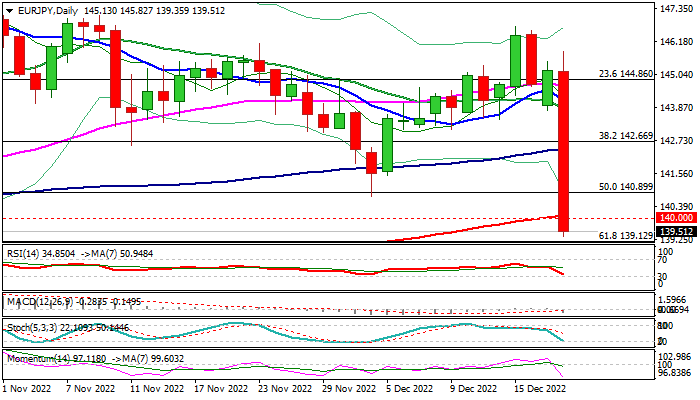

Sharp bearish acceleration generated strong bearish signals on break through significant supports at 140.89/76 (50% retracement of 133.39/148.40 / Dec 2 higher low) and 140.08/00 (200DMA / psychological).

Close below these supports is needed to confirm signal and open way for deeper fall, as the action is boosted by completion of bearish failure swing pattern on daily chart.

Daily studies weakened following today’s drop, as 14-d momentum moved to a steep fall and broke deeply in the negative territory, moving averages turned to bearish setup and the action surged through thick daily cloud, accelerating well below cloud base.

Bears eye target at 139.12 (Fibo 61.8% of 133.39/148.40 ascend, violation of which would further weaken near-term structure.

A massive bearish candle of today’s action is forming on daily chart and expected to weigh heavily, though some profit-taking after strong fall cannot be ruled out in coming sessions, as RSI and stochastic are about to enter oversold zone.

A breather would likely offer better levels to join bearish market, with corrective action to be ideally capped by broken Fibo support / former low at 140.80 zone and potential extended upticks to stay capped under broken 100DMA (142.36) to keep bears in play.

Only break here and penetration into daily cloud (base lays at 142.86) would sideline bears.

Res: 140.08; 140.89; 142.36; 142.86

Sup: 139.12; 138.04; 137.33; 136.93