Euro accelerated higher after weaker than expected US inflation data

The euro rose strongly in the US session on Thursday, after lower than expected inflation in October signaled that US consumer prices may have peaked that would allow Fed to start reducing the pace of rate hiking.

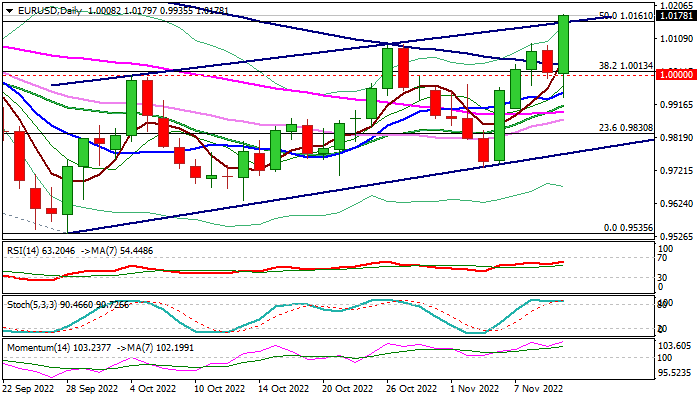

Fresh bulls pushed the price to two month high, following break through former double top at 1.0088/93 (Oct 26,27) and cracked pivotal Fibo barrier at 1.0161 (50% retracement of 1.0786/0.9535), pressuring September’s peak at 1.0197, violation of which would unmask targets at 1.0308 (Fibo 61.8%) and 1.0368 (August peak.

Bullish daily studies were reinforced by the latest advance, though overbought stochastic warns that bulls may slow in coming sessions.

Improved sentiment adds to bullish near-term outlook, with shallow dips to ideally stay above broken 100DMA (1.0033) and keep intact key supports at 1.0000/0.9954 (parity / daily cloud top).

Res: 1.0197; 1.0308; 1.0368; 1.0444

Sup: 1.0100; 1.0033; 1.0000; 0.9954