Euro benefits from improved risk sentiment, but still holding below pivotal 1.10 resistance

The Euro regained traction and bounces back on Tuesday, after a two-day pullback, lifted by renewed risk sentiment.

Much better than expected Chinese GDP and retail sales boosted hopes for economic growth, prompting investors into riskier assets.

On the other hand, German investor sentiment unexpectedly fell to 4.1% in April from 13.0 in March and signal that economic situation would remain unchanged in coming months, but so far with very limited negative impact on Euro.

Fresh recovery, however, needs more work on the upside to signal a higher low and end of corrective phase.

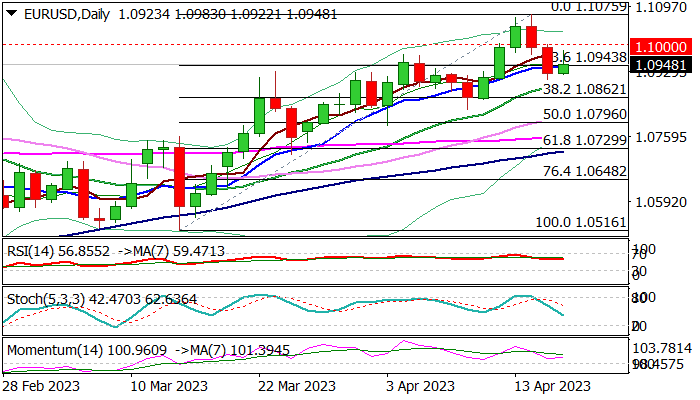

Break and close above psychological 1.10 level (reverted to solid resistance and also slightly above 50% retracement of 1.1075/1.0909 pullback), is needed to confirm a healthy correction and bring larger bulls back to play.

Bullish daily technical studies support the action, although possible stall under 1.10 pivot still cannot be ruled out.

Near-term action is expected to remain biased higher while holding above rising 20DMA (1.0896), with possible scenario of extended consolidation preceding fresh push higher.

Only loss of pivotal supports at 1.0862/31 (Fibo 38.2% of 1.0516/1.1075 / Apr 10 higher low) would sideline bulls and signal deeper pullback.

Res: 1.0980; 1.1000; 1.1032; 1.1075

Sup: 1.0896; 1.0862; 1.0831; 1.0796