Aussie dollar rises on hawkish RBA / upbeat Chinese GDP

Australian dollar rose by 0.7% in Asia / early Europe on Tuesday, lifted by hawkish RBA and stronger than expected China’s economic expansion in the first quarter.

The minutes of the last policy meeting showed that the Australian central bank considered to hike interest rates for the eleventh time on April 4 meeting before deciding to pause, but showed its readiness to further tighten its monetary policy if inflation remains high.

China’s stronger than expected economic data also contributed to fresh strength of the Aussie dollar.

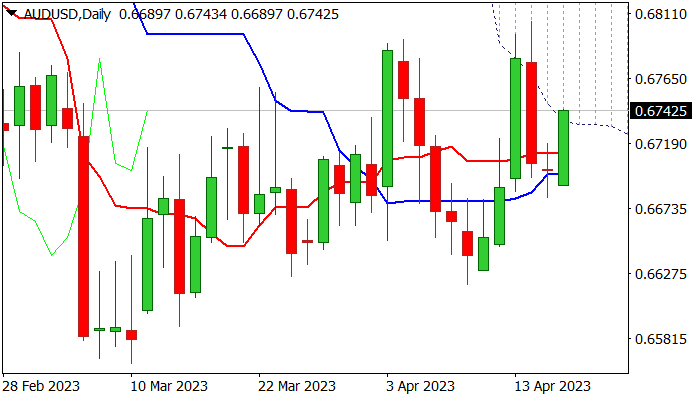

Tuesday’s rally generates reversal signal on daily chart as it follows last Friday’s sharp fall and long-legged daily Doji candle on Monday.

Bulls cracked the lower boundary of strong resistances at 0.6734/42 zone, consisting of daily Ichimoku cloud base; 200DMA and 50% retracement of 0.6805/0.6680 bear-leg, with firm break here needed to reinforce bulls for further recovery, as daily technical studies are still mixed (rising bullish momentum / south-heading stochastic / MA’s in mixed mode and the action weighed by thick daily cloud).

Break of 0.6734/42 pivots would open way for test of falling 55DMA (0.6761) which guards key resistances at 0.6790/93 / 0.6805 (Fibo 38.2% of larger 0.7157/0.6563 downtrend / tops of Apr 4/14, reinforced by 100DMA).

Failure to register close above 200DMA would ease upside pressure however, near-term bullish bias to remain as long as price action stays above broken daily Tenkan-sen (0.6712).

Only drop and close below daily Kijun-sen (0.6697) would sideline bulls and risk further weakness.

Res: 0.6761; 0.6790; 0.6805; 0.6841

Sup: 0.6712; 0.6697; 0.6680; 0.6646