Euro remains directionless for the third straight day and eyes ECB for direction signal

The Euro edges higher in European trading on Thursday but remains within the range of past two days ahead of key risk event – ECB policy meeting.

Stronger action after the central bank meeting is unlikely to happen as the ECB is expected to leave the massive bond buying and ultra-low rates unchanged this time, with more focus on June’s meeting when the central bank would announce possible reduction in the amount of bond purchases.

On the other side, if the ECB signals more stimulus, the single currency would come under increased pressure.

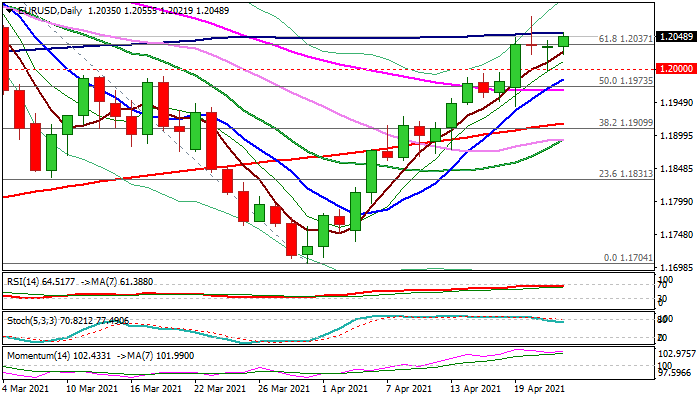

Two consecutive Dojis on daily chart (Tue / Wed) one with long upper shadow and the other with long tail, signal strong indecision and also point to strong headwinds that the single currency is facing on both sides (1.2092 – daily cloud top and 1.2000 – psychological support), with break of either side would provide fresh direction signal.

Larger uptrend from 1.1704 remains intact and current action looks like consolidation ahead of bullish continuation, but daily studies are overextended and warn of prolonged consolidation or possible deeper correction which could be sparked on firm break of 1.20 pivot.

Res: 1.2054; 1.2079; 1.2092; 1.2102

Sup: 1.2021; 1.2000; 1.1983; 1.1969