Sterling dips on fresh safe-haven dollar buying

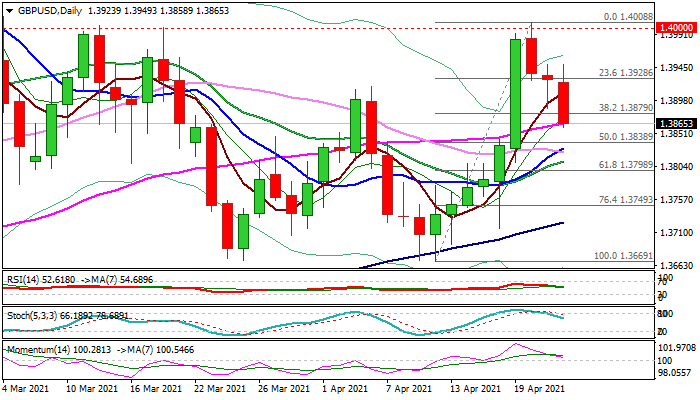

Cable accelerated lower on Thursday and broke pivotal Fibo support at 1.3879 (38.2% of 1.3669/1.4008 upleg), driven by stronger dollar on fresh safe-haven buying after India reported record number of new COVID cases, while better than expected US weekly jobless claims figure added to greenback’s positive sentiment.

Fresh bears pressure daily cloud base (1.3844) and Fibo 50% / converged daily Tenkan-sen/Kijun-sen (1.3838).

Close below daily cloud would further weaken near-term structure and risk dips below 1.38 mark.

South-heading 14-d momentum on daily chart is about to break into negative territory and boost bearish signals.

Near-term action is expected to remain biased lower while capped under 5DMA (1.3908)

Res: 1.3908; 1.3928; 1.3949; 1.3959

Sup: 1.3844; 1.3838; 1.3823; 1.3810