EURUSD is holding at key support zone ahead of EU inflation data

Bears are taking a breather early Friday and consolidating ahead of release of EU June inflation data.

The pair was down almost 0.9% in past two days, pressured by stronger dollar on solid US economic data which add to Fed’s hawkish stance.

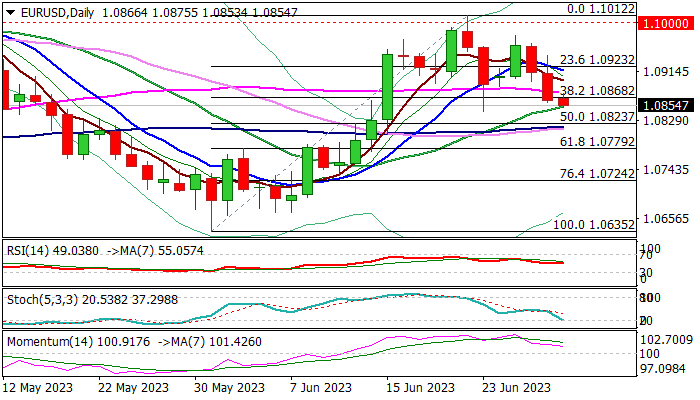

Thursday’s close below important Fibo support at 1.0868 (38.2% of 1.0635/1.1012) generated initial bearish signal, which will look for verification on weekly close below this level, with violation of nearby supports at 1.0853/44 (20DMA / June 23 trough) top to strengthen bearish near-term stance and open way for deeper drop.

Daily studies weakened and Monday’s twist of daily cloud is magnetic, contributing to negative outlook, however, overall picture is still bullishly aligned (14-d momentum is in positive territory and price action remains above daily cloud), requiring caution, as bears may face headwinds at this zone.

EU annualized headline inflation is expected to drop further in June (5.6% f/c vs May 6.1%) and provide some relief, but core CPI, closely watched by the ECB, is expected to rise to 5.5% in June from 5.3% previous month, which keeps the policymakers alerted and contributes to signals that the central bank will remain on hiking path.

We will be watching the reaction at 1.0840/50 zone, which is expected to generate fresh direction signal.

Firm break lower to signal bearish continuation and expose targets at (1.0823 (daily Kijun-sen / 50% retracement of 1.0653/1.1012) and 1.0779 (Fibo 61.8%) in extension.

Conversely, failure to break lower would question near-term bears, with lift and close above 55DMA (1.0877) to ease downside pressure, but more work at the upside will be required (break above 10DMA at 1.0916) to signal reversal.

Res: 1.0868; 1.0877; 1.0916; 1.0976

Sup: 1.0844; 1.0823; 1.0813; 1.0779