Probe through pivotal Fibo support faces strong headwinds again

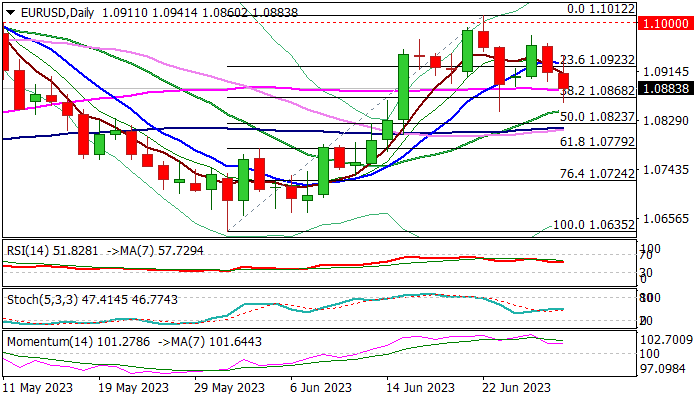

EURUSD remains at the back foot and extends weakness into second straight day, cracking pivotal supports at 1.0883/68 (55DMA / Fibo 38.2% of 1.0635/1.1012 upleg).

German inflation rose above expectations in June, adding to rate hike prospects, but positive impact was partially offset by solid US data which added support to hawkish Fed outlook and lifted dollar.

Fresh bears need to close below 1.0868 Fibo support to confirm initial signal, which will be reinforced by extension below 1.0844 (Jun 23 higher low / 20DMA) and completion of daily failure swing pattern.

However, last week’s (June 23) strong downside rejection which left a bear-trap, warns of strong bids in this zone, with still bullish daily studies supporting the notion and adding to warning of repeated rejection here.

In such scenario, near-term action will hold in a sideways mode, as long as it’s capped by 10DMA (1.0927) and await fresh direction signal.

Res: 1.0927; 1.0976; 1.1000; 1.1012

Sup: 1.0868; 1.0844; 1.0823; 1.0813