Euro loses traction but more evidence needed to signal recovery stall

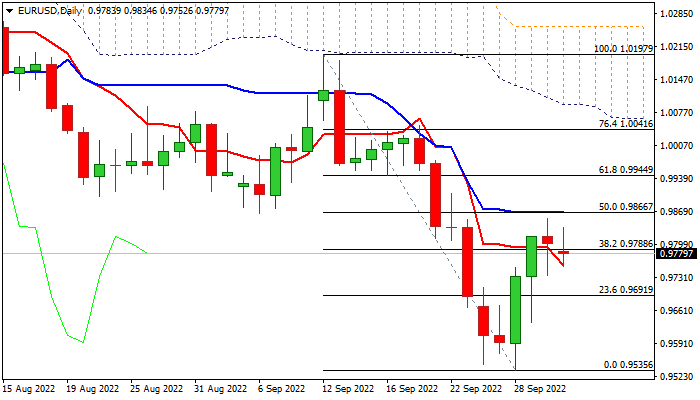

The Euro remains at the back foot on Monday, weighed by weak EU PMI data and higher oil prices, as well as bloc’s record inflation, while last Friday’s bearish Doji candle generates initial warning that three-day recovery might be over.

Monday’s action is holding in red, although still without clear direction, as fresh bears pressure initial support at 0.9755 (daily Tenkan-sen), with break here to generate initial negative signal, which will be confirmed by extension and close below pivotal support at 0.9732 (Fibo 38.2% of 0.9535/0.9853).

Overbought stochastic on daily chart and momentum holding deeply in the negative territory, support bearish near-term scenario.

Monthly drop of 2.5% in September (the fourth consecutive month in red) signals that bears are firmly in play, although last week’s bullish close suggests that bears may hold in extended consolidation before continuing.

Res: 0.9834; 0.9853; 0.9866; 0.9907

Sup: 0.9755; 0.9732; 0.9694; 0.9657