Euro regains traction on positive fundamentals but strong US inflation reading may weigh on bulls

The Euro edges higher in European trading on Thursday, signaling an end of a shallow pullback from new three-month high (1.1483).

Comments from German Ifo Institute that industrial order backlog is the highest in more than 40 years and could strongly boost the economy if persisting supply shortages ease, improved the sentiment and lifted the single currency.

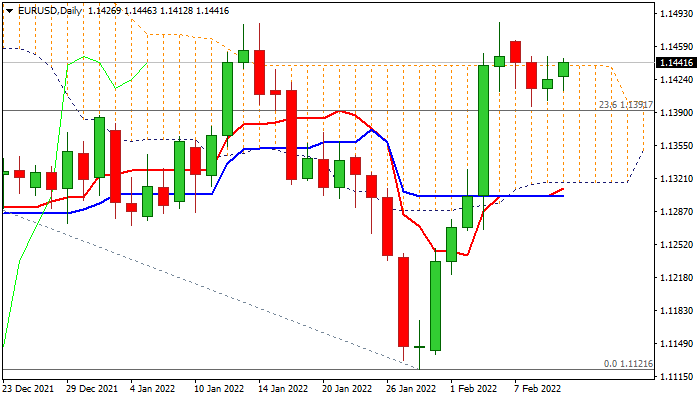

Fresh strength probes again through the top of thick daily cloud (1.1439) with close above here to generate fresh bullish signal for retest of 1.1483 peak and attack at 200WMA (1.1497), violation of which would signal continuation of recovery leg from multi-month low at 1.1121 (Jan 28 low).

Bullish daily studies support the action, but traders focus on key US CPI data, as inflation is expected to rise to a 40-year high at 7.3% in January that would boost expectations for future rate hikes and lift the dollar, putting the Euro in defense.

Initial support lays at 1.1396 (low of shallow pullback), followed by 1.1345 (Fibo 38.2% of 1.1121/1.1483 rally) and pivotal daily cloud base (1.1316).

Res: 1.1447; 1.1483; 1.1497; 1.1558

Sup: 1.1396; 1.1345; 1.1316; 1.1300