Euro remains in red despite solid EU/German data and US retail sales miss

The Euro stands at the back foot at the beginning of the US session on Wednesday, despite solid EU / German GDP data and disappointing US retail sales.

German GDP rose 0.4% in Apr while EU figures came in line with expectations, but US retail sales disappointed (Apr -0.2% vs 0.2% f/c and 1.7% prev).

Bearish daily MA’s and Ichimoku studies maintain pressure, as the pair holds in red for the third day, with sentiment additionally weighed by political turmoil in Italy ahead of EU elections.

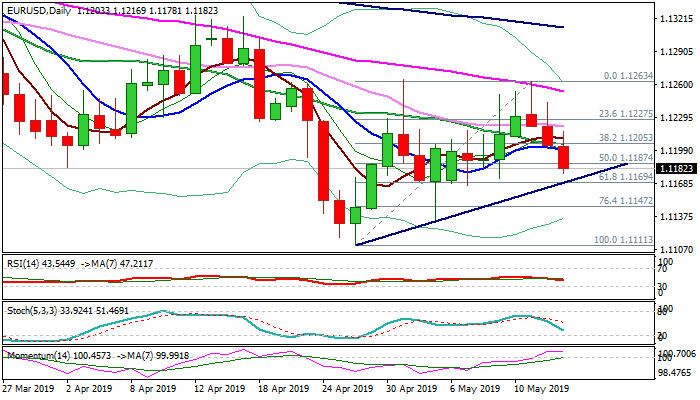

The pair dipped to new one-week low at 1.1178 after marking over 50% retracement of 1.1111/1.1263 upleg.

Bears eye key support at 1.1170 zone (Fibo 61.8% / bull-trendline drawn off 2019 low at 1.1111) violation of which would generate bearish signal on confirmation of 1.1263 double-top, for further weakness.

Converged 10/20SMA’s and broken Fibo 38.2% support mark solid barriers at 1.1200/05 which should ideally limit upticks.

Res: 1.1200; 1.1221; 1.1244; 1.1263

Sup: 1.1170; 1.1147; 1.1134; 1.1111