Euro stands at the back foot after Friday’s sell-off; US/China trade tensions seen as key driver

The Euro holds within narrow range in early Monday’s trading, consolidating last Friday’s strong losses, as the single currency was sold on rising US-China trade tensions that inflated dollar.

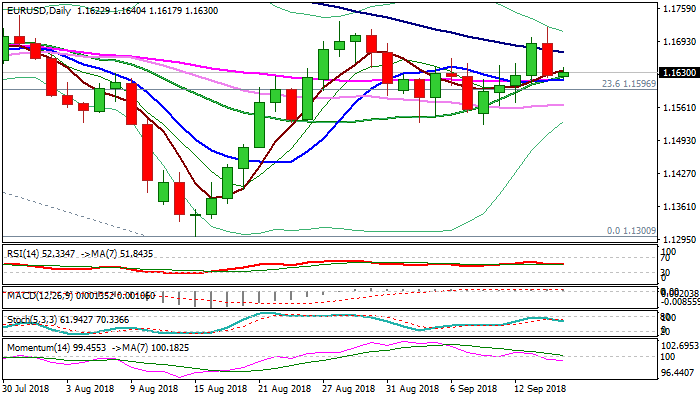

Friday’s action created bearish engulfing and generated negative signal, which is reinforced by close below 38.2% retracement of last week’s 1.1526/1.1721 rally.

Converged 10/20/55SMA contained dip, offering initial support at 1.1614, ahead of pivotal support at 1.1600 (Fibo 61.8%), loss of which would confirm reversal and possibly lead towards full retracement of 1.1526/1.1721 upleg.

Bearish momentum is building and supporting near-term action, along with south-heading slow stochastic, after false break above falling 100SMA (currently at 1.1672.

Thick hourly cloud stands above (spanned between 1.1639 and 1.1673), marking strong barrier which should limit upside attempts.

US / China trade issue is expected to be the key driver these days, as tensions rose after US announced additional tariffs over the weekend and China threatened of cancelling trade talks in such scenario.

Res: 1.1640; 1.1673; 1.1701; 1.1721

Sup: 1.1614; 1.1600; 1.1572; 1.1526