EURUSD eases on weaker demand; markets await for ECB’s verdict

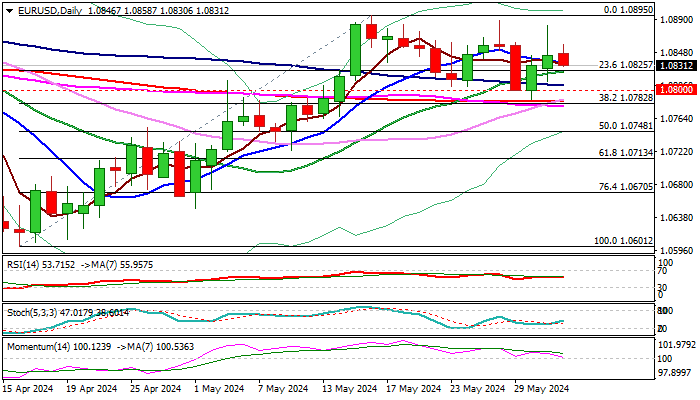

The Euro started to lose traction in European trading on Monday, adding to initial warning from Friday’s daily candle with long upper shadow, which was formed after strong upside rejection.

Initial signal of two-day recovery stall was boosted by a double-top formation on hourly chart (1.0858).

Fresh weakness needs to clear pivotal support at 1.0825 (20DMA) to add to downside prospects.

Daily studies are mixed as 14-d momentum is heading south and MA’s remain in bullish setup, though near-term bias expected to remain with bulls while the price stays above 20DMA and larger bulls to remain in play above daily cloud top / 200DMA (1.0791/85).

Weekly long-legged Doji candle also contribute to uncertain near-term outlook.

Fundamentals are expected to play significant role this week, as markets focus on EU PMI’s, reports from the US labor sector and key event of the week – ECB policy meeting, with wide expectations for the first rate cut.

Markets will also closely watch ECB’s comments and economic projections, to get more details about the central bank’s action on monetary policy in coming months..

Res: 1.0858; 1.0882; 1.0895; 1.0942

Sup: 1.0825; 1.0810; 1.0785; 1.0748