EURUSD – Increased risk of deeper fall

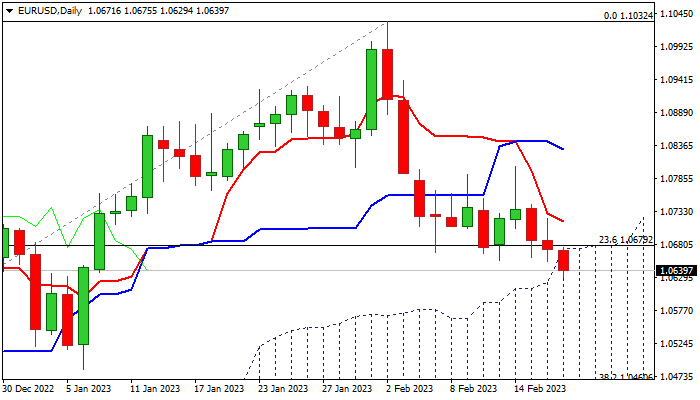

The Euro dips to the lowest levels since Jan 6 on Friday, with break below the floor of recent multi-day range, signaling bearish continuation.

Fresh weakness also broke into rising daily cloud which offered significant support, adding to growing bearish signals, which will be confirmed on close within the cloud.

Stronger dollar on growing expectations that the US central bank will remain on policy tightening path, keeps the single currency under pressure.

The pair is on track for the third weekly close in red, with long upper shadow on this week’s candle, signaling that the Euro is strongly offered.

Daily studies maintain strong bearish momentum, which contributes to negative setup of moving averages and south-heading RSI.

Bears turn focus towards targets at 1.0483/1.0460 (Jan 6 low / Fibo 38.2% of 0.9535/1.1032), which guard pivotal daily cloud base (1.0361).

Daily cloud top (1.0675) reverted to initial resistance, followed by daily Tenkan-sen (1.0716) which should ideally cap upticks.

Res: 1.0675; 1.0716; 1.0795; 1.0830

Sup: 1.0629; 1.0596; 1.0519; 1.0483