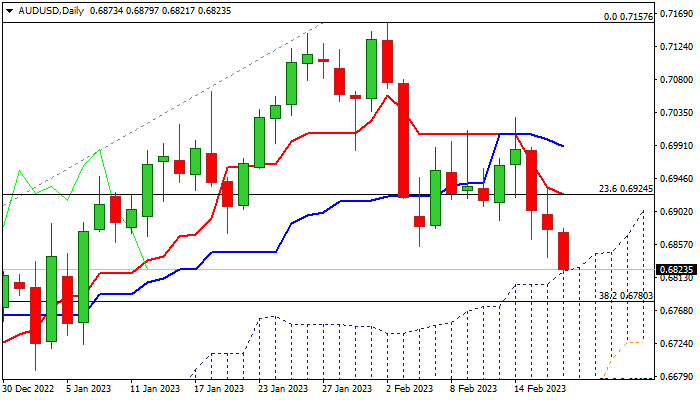

Extended bears test key support zone

The AUDUSD holds in a steep fall for the third straight day, pressured by risk aversion as the US dollar rises on expectations of further rate hikes.

Fresh bearish acceleration on Friday (the pair was down 0.7% in Asia / early Europe) cracks the upper boundary of strong support zone at 0.6820/0.6780 zone, consisting of the top of rising daily cloud, 200DMA and Fibo 38.2% of 0.6170/0.7157).

Bears may face headwinds here as daily stochastic is oversold and 14-d momentum stretched, adding to prospects of consolidation / mild correction, before bears break lower and signal continuation of the downtrend from 0.7157 (2023 peak, posted on Feb 2).

Former low at 0.6855 (Feb 6 low) offers initial resistance, followed by broken 55DMA at 0.6872 and daily Tenkan-sen / broken Fibo 23.6% (0.6925) to limit extended upticks and keep bearish bias.

Res: 0.6855; 0.6872; 0.6925; 0.6973

Sup: 0.6804; 0.6780; 0.6722; 0.6687